Our Services

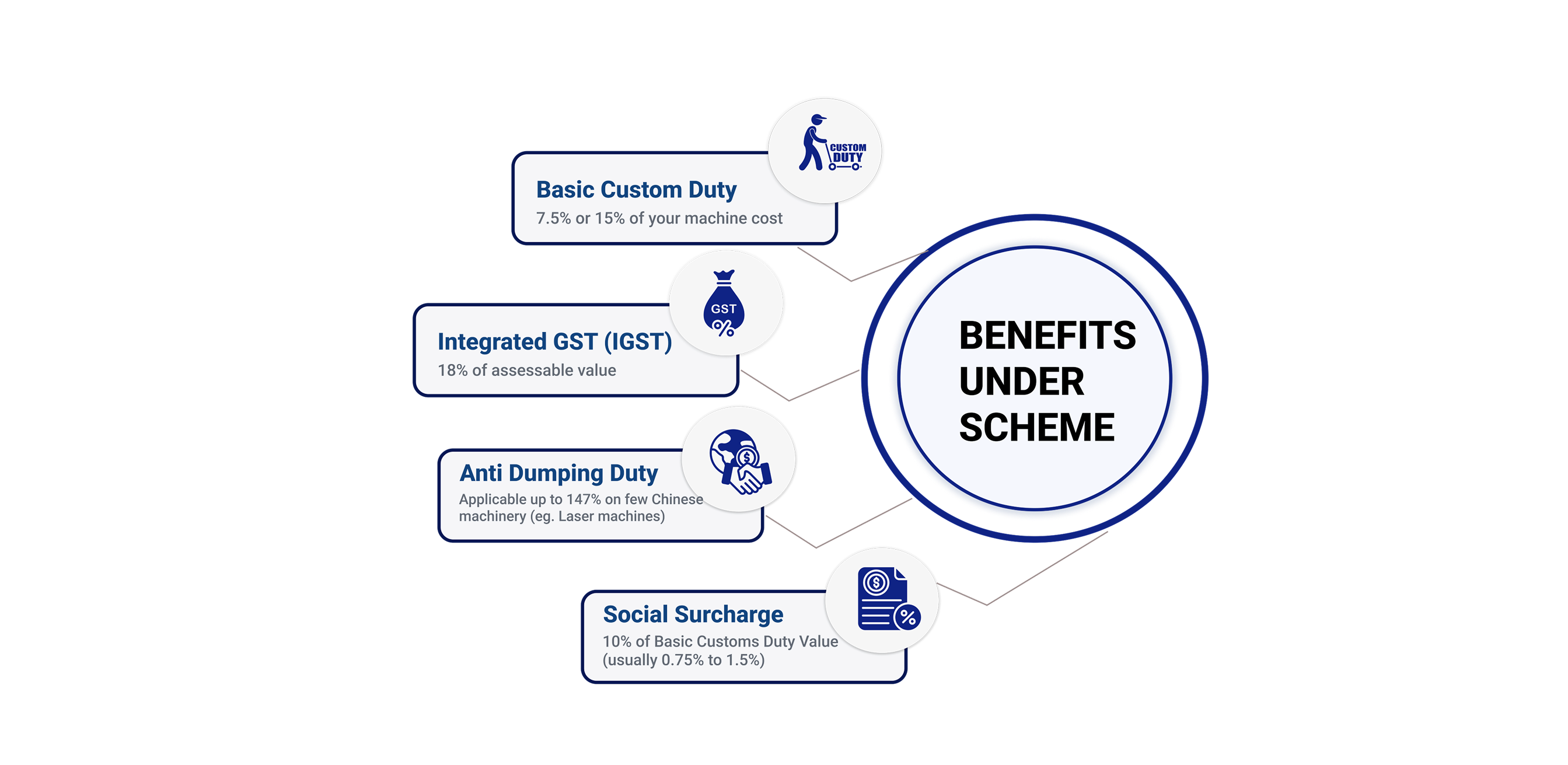

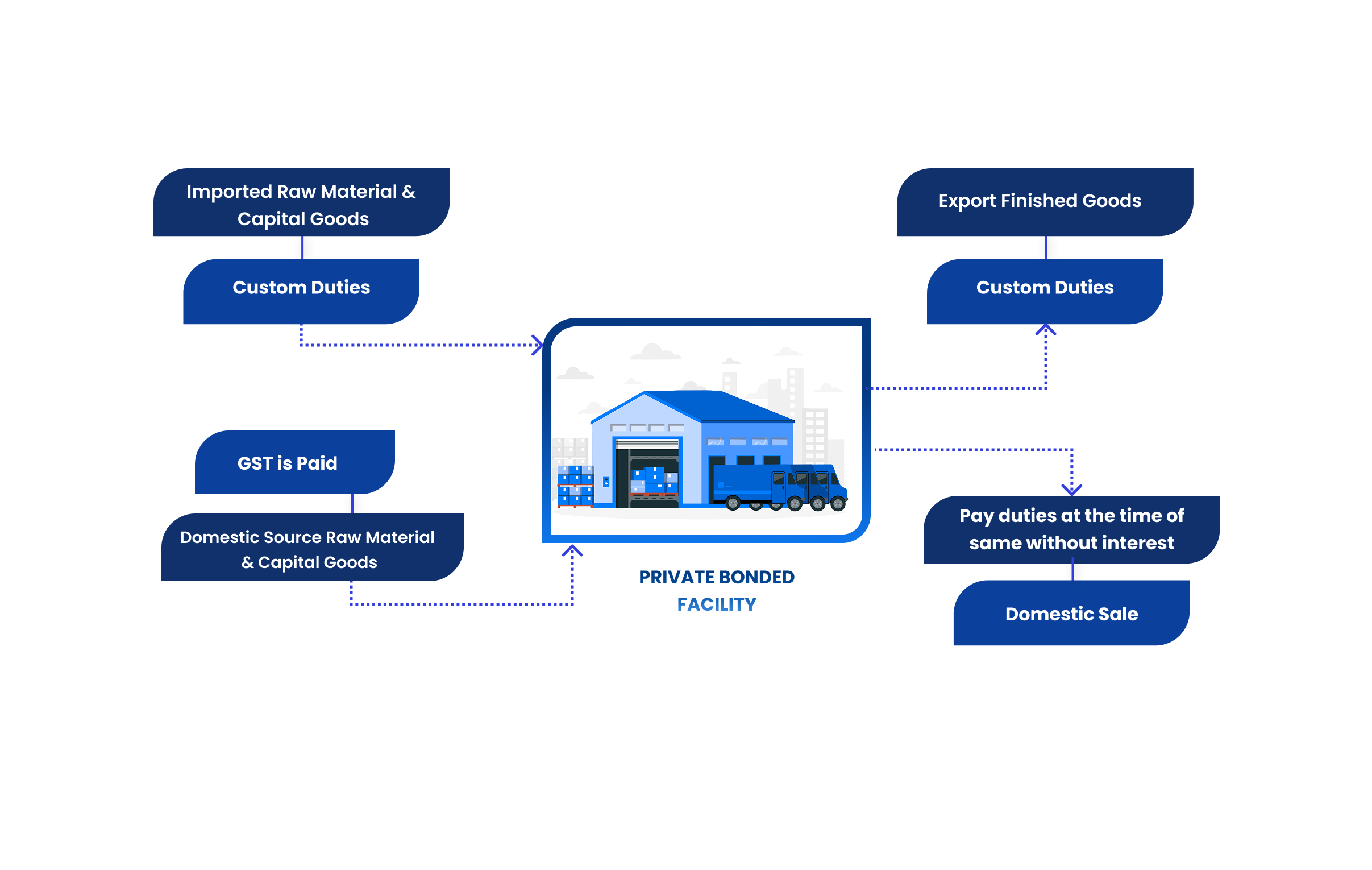

Manufacturing and Other Operations Under Warehouse Regulations (MOOWR,19)

Save Import Duty and IGST on Import of machinery and raw material.

How Does It Work?

Our Work

Real Impact, Measurable Success

Expanding horizons, optimizing savings, and streamlining approvals—helping businesses thrive across India.